What is Payday Super?

Note: The relevant legislation passed both houses of parliament on 4 November 2025. The ATO website will contain the most current information regarding Payday Superannuation.

With a commencement date of 1 July 2026, Payday Superannuation is an initiative to reduce unpaid super and ensure employees' superannuation accounts receive contributions in a timely fashion. The legislation passed the Australian parliament on 4 November 2025. Payday Superannuation will require superannuation to be paid at the same time as regular salary or wages, instead of the current quarterly requirements. Further, super contributions must hit member accounts within 7 business days of pay date, and super funds have 3 days to match the funds to members where auto matching fails.

Unlike other recent initiatives, there is no scope for deferrals; the ATO will most likely work with employers on compliance issues before jumping straight to penalties, unless the breaches are deliberate.

Ordinary Time Earnings

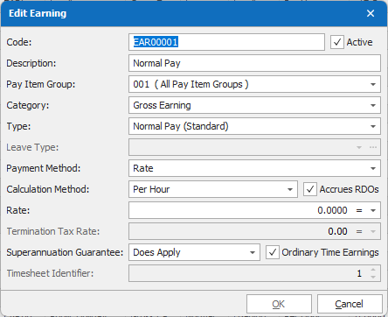

Prior to Version 25.10, Sybiz Visipay had an informal concept of OTE; this has now been formalised as a check box in pay items in Version 25.10. However, as more information has materialised from the ATO there is a new term, Qualifying Earnings (QE) which denotes whether a pay item would ordinarily attract super. As such, it is crucial for Sybiz Visipay users to revisit their pay items and ensure OTE (will be relabelled as QE from Sybiz Visipay 26.00) is being applied correctly to the relevant pay items. Reporting of QE will be required under STP2.

Importantly, the definition of OTE and pay items that are treated as OTE has not changed.

Qualifying Earnings

Qualifying Earnings includes all pay items that are currently treated as OTE (with some exclusions; such as the excess of earnings above the Maximum Superannuation Contribution Base and employees under 18 working less than 30 hours in a week), and also includes additional amounts that are not classified as OTE (for example, bonuses and commissions earned wholly from work performed outside of normal hours).

Please refer to the ATO resources regarding these terms; the ATO has requested us to link users directly to the information rather than republishing it.

We also invite Sybiz Visipay users to check our our Getting Ready for Payday Super webinar, a recording of which has been made available on our site. But please be aware updated information will be more reliable as it becomes available.

Planning ahead

There are steps Sybiz Visipay users can take now ahead of Payday Super to prepare for its future implementation:

- Sybiz Visipay 25.10 has added a flag to designate pay items as Ordinary Time Earnings. Familiarise yourself with OTE per the new content available on the ATO website (The ATO has requested we send users there, rather than republish information). Note that the name of this flag has changed to Qualifying Earnings (QE) from Sybiz Visipay 26.00.

- Review director's fees, and bonus and commission pay items regarding the applicability of super.

- Review your pay frequency as it may make sense to change to a less frequent payroll to reduce the administrative burden.

- Make plans now to move away from the Small Business Superannuation Clearing House, which will cease operation on 1 July 2026.

- Be aware that the Maximum Super Contribution Base is changing from Quarterly to Annually.

Payday Super webinars

Please broaden your search parameters

Success story

Gearon Civil

Read how Sybiz accounting and payroll helped a growing business save time and improve performance.