Salary Sacrifice and STP2

The reporting of salary sacrifice under STP2 has changed compared to STP1. From a processing perspective, salary sacrifice to super is unchanged. However, changes may be required to the manner in which some non-super salary sacrifice items, otherwise known as salary sacrifice other are processed.

The concept of salary sacrifice reporting in STP2 is that the source of the salary sacrifice is grossed back up to its pre-sacrificed value and the salary sacrifice is reported separately.

The key change that is required when processing salary sacrifice other for reporting under STP2 is that the sacrifice is now processed as deduction, rather than a negative earning item.

The following example looks at the pre-STP2 and post-STP2 methods of processing a salary sacrifice for an exempt benefit, such as a portable electronic device. It is important to note that if an employee is salary sacrificing in instalments (as this example shows the full benefit being provided and the sacrifice occuring via 12 instalments) and transcending financial years that their pay profile will need to be adjusted prior to processing pays for the 2022/23 financial year.

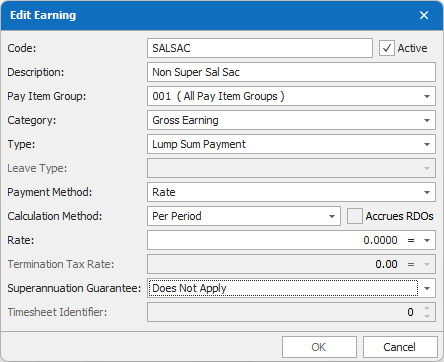

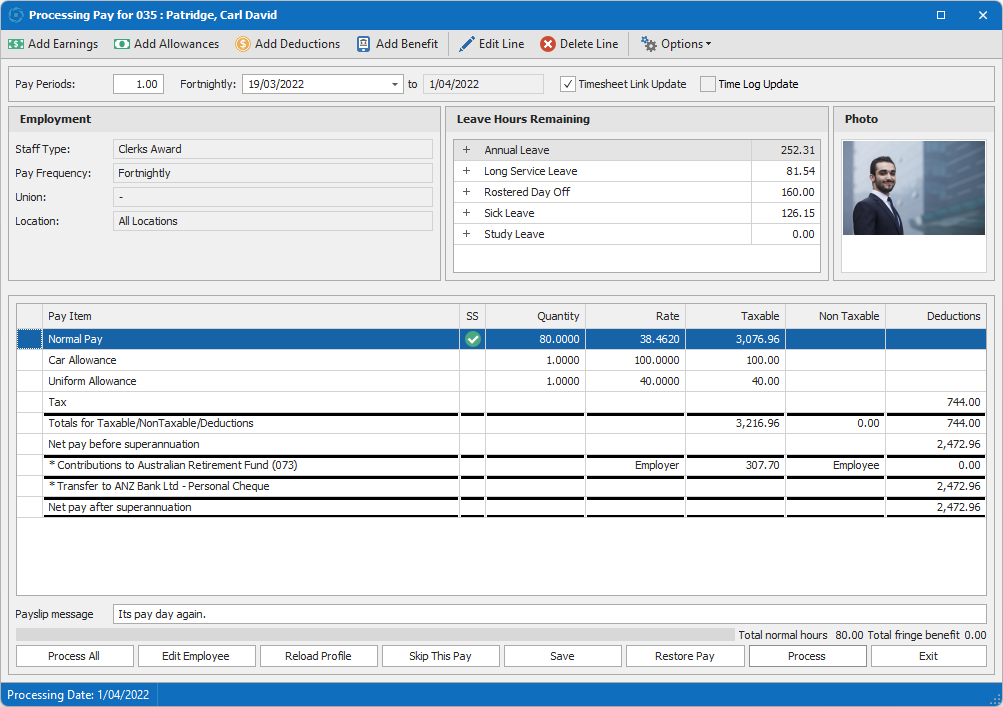

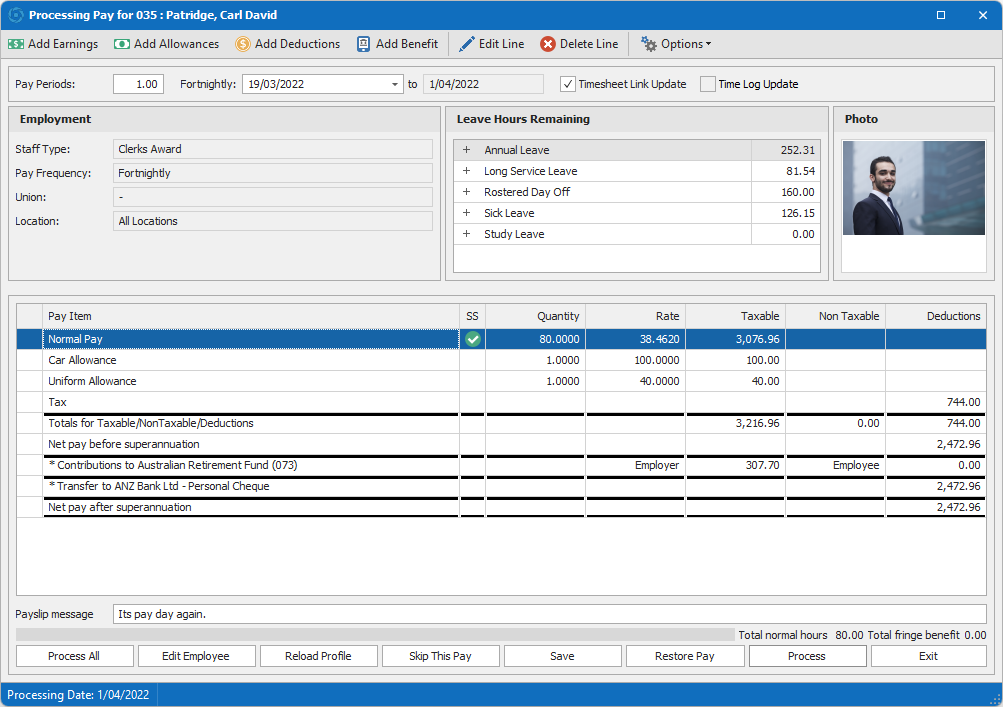

Prior to STP2 we would process a negative amount to an earning pay item to represent the salary sacrifice. This would serve the purpose of reducing gross earnings and therefore tax whilst leaving superannuation calculations at the same level had the salary sacrifice not occurred.

We could then use an Exempt Benefit pay item to represent the value of the benefit gained in place of the salary sacrifice.

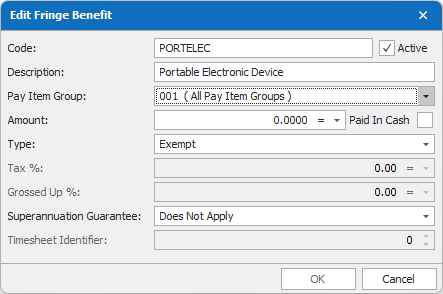

Prior to adding the salary sacrifice, tax is $744 and Employer Super is $307.70.

After adding the two lines for salary sacrifice, tax is now $710 and Super remains at $307.70.

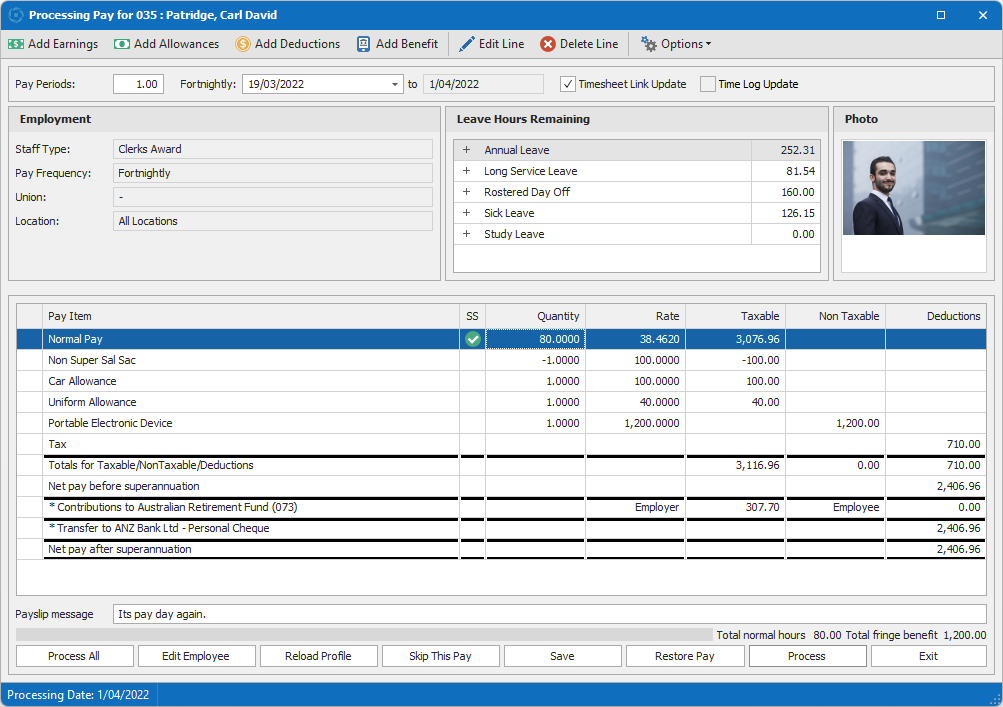

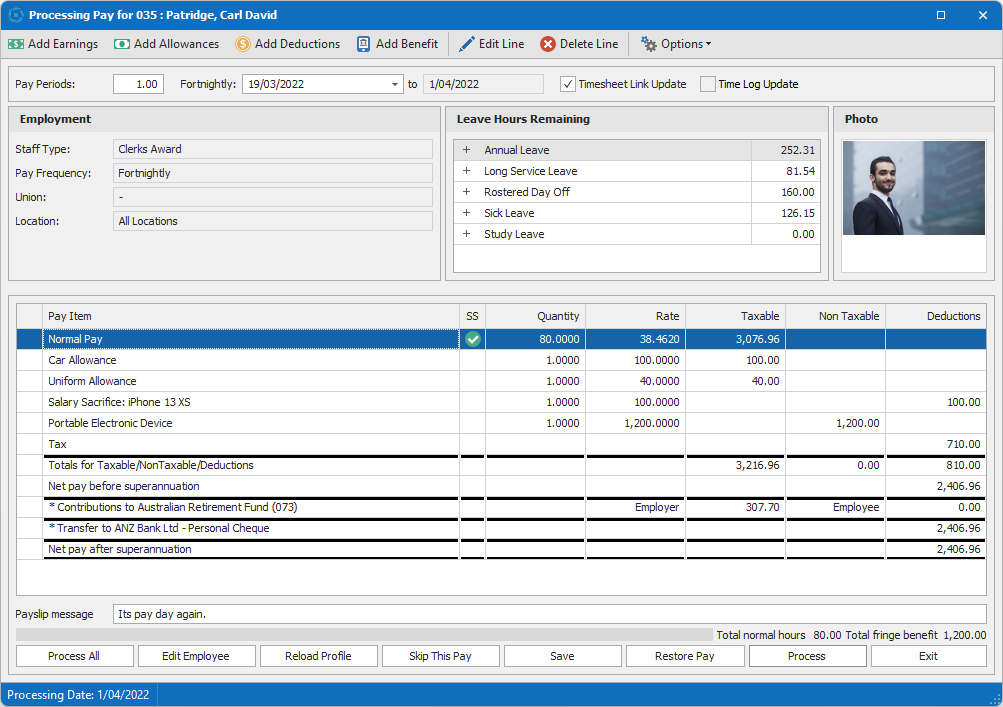

Under STP2 we take a different approach to achieve the outcome of reducing tax without reducing the gross amount reported through STP2.

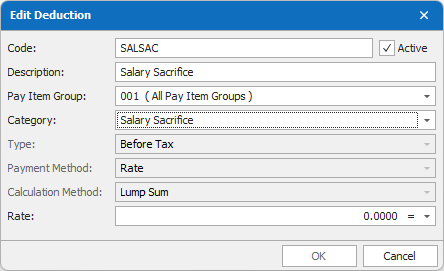

We create a new deduction pay item that is set to the new Category of Salary Sacrifice.

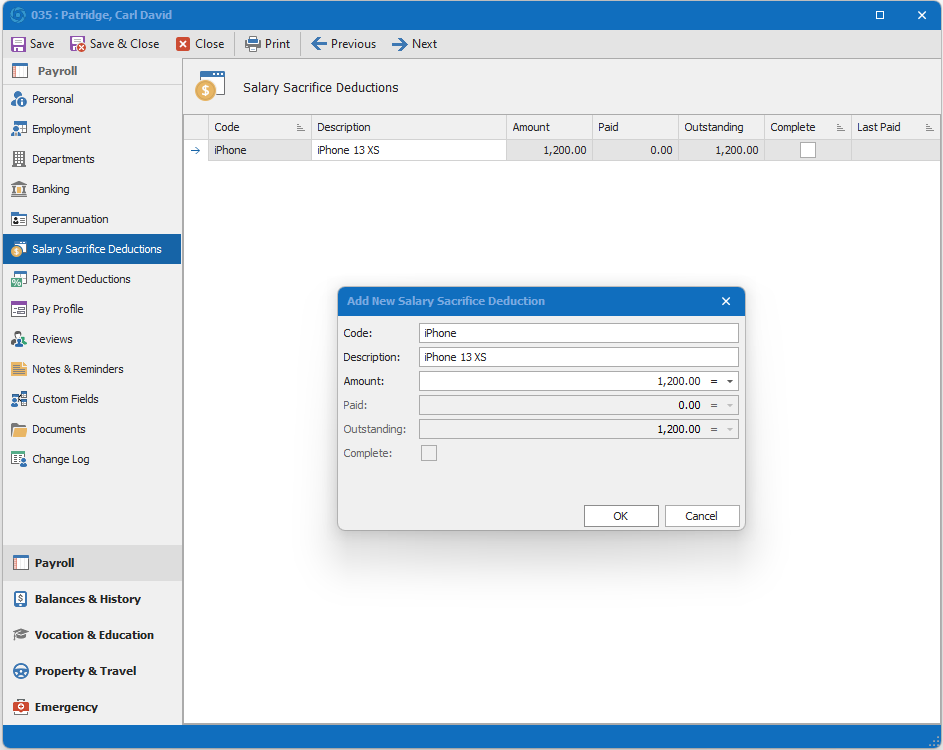

Additionally, we configure a salary sacrifice item in the Employee’s record which allows us to keep track of the sacrifice amount vs the benefit attained. This is especially useful if the employee has arranged to periodically sacrifice, rather than sacrificing a single lump sum.

Prior to adding the additional items to the payslip we can see the tax and super amounts are the same as they were under STP1.

Under STP2 we need to treat the salary sacrifice as a deduction, rather than a negative earning, and select the relevant salary sacrifice item.

In addition, the salary sacrifice benefit is being conveyed in this pay, as per the STP1 example. Tax and superannuation are as expected and in line with the values under STP1.

For more STP2 help in Sybiz Visipay, take a look at our STP2 FAQs.

Success story

The right fix for FIX-A-TAP

When FIX-A-TAP sought a modern, effective solution to their payroll and human resource difficulties, choosing a vendor who shared their experience and dedication to customer service was the obvious choice.