STSL changes (September 2025)

STSL changes from 24 September 2025

On 2 August 2025, the Universities Accord (Cutting Student Debt by 20 Per Cent) Bill 2025 became law. From 24 September 2025, not only are the Study and Training Support Loans (STSL) rates changing but the calculation method for STSL is changing too.

From a Sybiz Visipay perspective, changes will be required to employees that are subject to STSL (also referred to as HECS/HELP/SFSS).

New Tax and STSL scales will be published by Sybiz and downloaded into Sybiz Visipay, ready for use from 24 September 2025. The STSL scales will be zeroed out, and employees subject to STSL will need to be aligned with a new Tax Scale for the calculation of STSL to continue. In other words, STSL is no longer a separate calculation, as it is now combined into new tax scales.

From this time, STSL amounts will be swept up into the general tax bucket, meaning that STSL amounts in reports such as the Yearly Balance List will remain static.

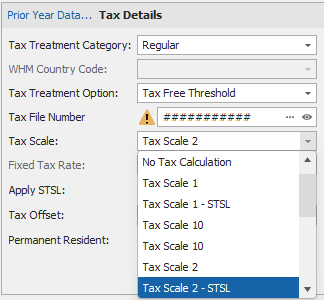

Prior to processing pays on or after 24 September 2025, you will need to review employees that are subject to STSL and change their Tax Scale accordingly. For example, an employee currently on Tax Scale 2 will need to be changed to Tax Scale 2 - STSL.

You must leave the Apply STSL flag checked in employee records, as that informs the ATO, via STP2 reporting, that the employee’s tax treatment includes STSL.

Important: the tax scale update in Sybiz Visipay is triggered during the pay processing routine. Therefore, for the new tax scales to become available for selection, you must commence a pay run with a processing date on or after 24 September, then cancel out of the pay run once the tax scales have been updated, after which they will become available for selection. The tax scale update is also triggered upon the monthly rollover into October.

In the event that many employees are subject to STSL, the Export/Import process within Sybiz Visipay can be utilised.

Whilst no software update is required to accommodate these changes, Sybiz always recommends the latest version is in use. All customers will need to upgrade prior to the end of the 2025/26 financial year when the Payday Super-ready version becomes available.

It should be noted that there is an edge case in that employees that are moved onto the Tax Scale 5 - STSL or Tax Scale 6 -STSL that need to submit a Final Event prior to the end of 2025/26 will require their tax scales to be changed back to the non-STSL versions prior to submitting their final event to ensure the tax treatment code is correct.

*This page was previously linked off the FAQ menu but has been disconnected but retained for searching purposes.

Process overview

This process is to be conducted prior to the first pay run on or after 24 September and after all pay runs up to 23 September have been completed:

- Once the updated tax scales have been published (you can check by hovering your mouse above the tax scale icon in the top right corner of Sybiz Visipay), start a pay run with a processing date on or after 24 September 2025 to trigger the tax scale update.

- Cancel out of the pay run.

- Log out of Sybiz Visipay and log back in (if this step is skipped and an error regarding the Tax Treatment is received upon submitting STP then complete this step and repeat the next step).

- Change the tax scale of employees that are subject to STSL, eg an employee on Tax Scale 2 will need to be changed to Tax Scale 2 - STSL.

- Double check to ensure all relevant employees have been included by using the Complete Employee Records report or an export of employee data.

Note: Steps 1 & 2 are not required if you need to roll into the October month prior to processing your first pays beyond 23 September. However, be sure to complete Step 3 once the tax scale updates have applied through the month end rollover process.

Frequently Asked Questions

No, this process only applies to employees for whom STSL applies.

Tax withheld will be less than required and will cause a nasty surprise for employees when they file their tax returns. Employees subject to STSL will be expecting an increase in take home pay and will not necessarily realise if their tax withholding is too low.

No, the flag is to be left on as long as it continues to apply as it forms part of STP2 reporting.

No, the existing Tax Scales will remain as is. It is just the addition of new, combined tax and STSL scales that will result in changes.

We recommend using the employee export function under the Utilities menu to export Employee Number, Apply STSL & Tax Scale fields; the export wizard can be filtered to only include those with STSL. The Tax Scale can be updated in the exported spreadsheet and then used to import back into Sybiz Visipay. Alternatively, the Complete Employee Records report can be used.

Due to the change in calculation method, the STSL is indistinguishable from other tax withholdings, so new STSL values now form part of the Tax total, rather that the STSL total. It should be noted that even though Sybiz Visipay has disaggregated the figure in the past the STP reporting has always aggregated the amounts per ATO requirements. You may wish to edit your payslip layouts to avoid confusion.

Because your processing date is 15 September you continue as normal. Prior to your October pay, run the tax scale update and edit the relevent employees, as that will be your first pay run on or after 24 September 2025.

No, when employees file their tax returns, they will recoup any excess withholding that has occurred year to date.

The tax scales with a '- STSL' suffix will be present after the tax scale update completes.

This is to be expected as that is the nature of the legislation change. Double check to ensure the correct tax scale has been associated with the employee as a non-STSL tax scale will generally increase take home pay by a greater value for those earning above $67,000 per annum.