What’s New Sybiz Visipay 23.00

Important Information

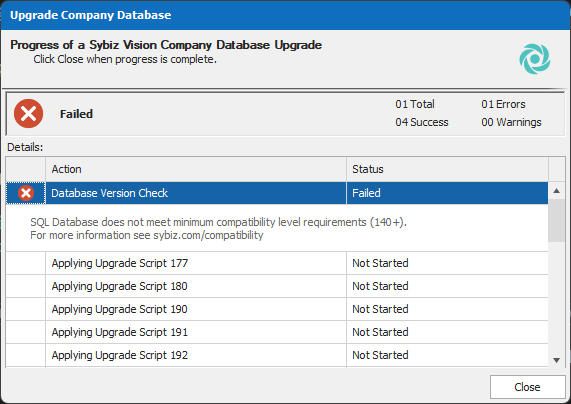

Minimum supported version of Microsoft SQL Server

The minimum supported versions of Microsoft SQL Server for Sybiz Visipay 23 have moved from 2012 to 2017. These compatibility levels are enforced with a message displaying on upgrade to version 23.00 if the user’s minimum requirements fall outside of this scope prior to the database being upgraded.

We recommend that anyone upgrading their Microsoft SQL Server upgrades to the latest version available at the time, rather than to the minimum supported version, for not only greater longevity but also better performance capabilities.

Single Touch Payroll Phase 2 (STP2) deferral

The Australian Taxation Office (ATO) extended Sybiz’s STP2 deferral until 31 October 2022 as they preferred a staggered roll out among payroll products. This deferral automatically covered all Sybiz Visipay customers until this date.

Sybiz Visipay 23.00 has been released with the new deferral date pre-configured, meaning STP2 reporting is automatically activated on upgrade.

Web Service/ESS app requires upgrading

The Web Service that powers the ESS app was upgraded in Sybiz Visipay 22.00, resulting in ESS and the Web Service being combined. The old Web Service is not supported from Sybiz Visipay 22.20. If you are still running the ESS app from the old Web Service you will need to the new combined ESS/Web Service (named ESS) prior to upgrading to version 23.00. To check your Web Service, please contact your Sybiz Authorised Business Partner.

Operating system compatibility

Certain older operating systems (Microsoft Windows XP, some versions of Microsoft Windows Vista and Microsoft Server 2003), Microsoft SQL Server (2008, 2008R2, 2012, 2016), and Microsoft Windows Server 2012 are not compatible with Sybiz 23.00 - if uncertain consult your Authorised Business Partner prior to upgrading. Microsoft Windows 11 is supported for Sybiz 22+ with compatibility extending to some other later versions of Sybiz solutions.

DevExpress upgrade

Version 23.00 of Sybiz Visipay utilises DevExpress version 22.1.6.0.

New Features

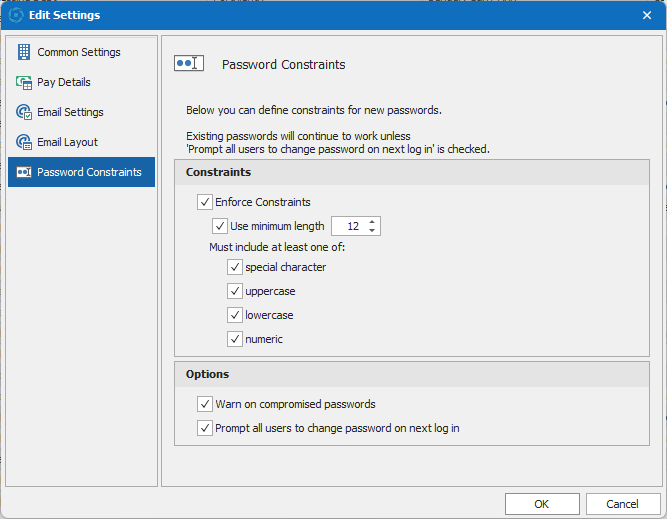

New ways to manage password security

System administrators are now able to set warnings in Sybiz Visipay to advise users that their chosen password is insecure, inappropriate for their requirements or has been breached in some format online. Passwords can also be constrained to use certain types of characters, and a minimum length enforced for more secure passwords company wide.

System administrators can also now request all users change their password on their next login. This is especially useful if there has been a security issue within the business, or if you are setting up password constraints for the first time.

This new feature is not automatically enabled for existing customers who are upgrading but will be turned on as a default for new companies or new installs and applies to the Visipay ESS mobile app. Turn this feature on in the File > Settings > Password Constraints menu. (CR110913664)

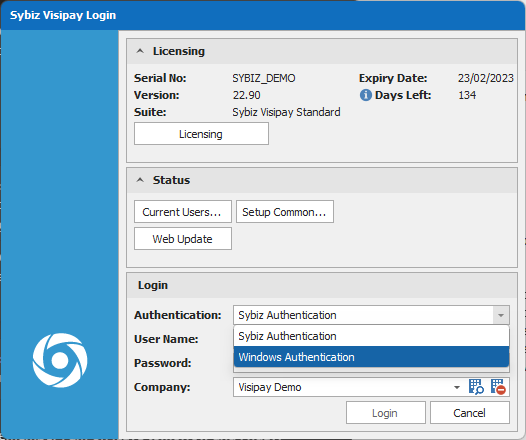

Microsoft Windows Authentication for Sybiz Visipay

Users are able to utilise their Microsoft Windows Authentication for login to Sybiz Visipay instead of their unique Sybiz credentials if configured by System Administrators, adding further layers of protection to your data with multi-factor authenticators, especially when working off-site and making logging in even easier for employees.

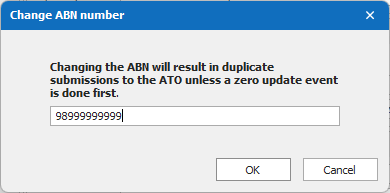

Restrictions on changing ABN

New restrictions have been put in place to reduce potential issues with STP2 when changing Company Name and ABN for a database in Sybiz Visipay. Now when the ABN is changed, a warning will notify the user to process a zero update event via the ATO Transfer option. (CR2207-0840)

Ready to Report: Single Touch Payroll Phase 2 (STP2)

The Australian Taxation Office (ATO) extended Sybiz’s STP2 deferral until 31 October 2022. The ATO has had to interact with employers reporting under STP2 to a greater extent than they did with STP1 and the deferral helps the ATO stretch out the volume of employers transitioning to STP2 over a longer time frame. This deferral automatically covers all Sybiz Visipay customers.

Sybiz Visipay 23.00 has been released with the deferral date pre-configured, meaning STP2 reporting will be automatically switched on for upgrades after 1 November 2022 and there is no action required by users to switch to STP2.

Multiple references are made to the ATO in the content below and ATO resources pertaining to STP2 are readily accessible via the ATO website. The ATO has requested software developers to refrain from republishing the information as it is being updated and extended on a regular basis. Therefore, the ATO resources should be used as the source of this information.

Get ready for STP2 with Sybiz Visipay

Sybiz Visipay 22.10 included a number of changes that helped customers get prepared for STP2 - further changes, including the ability to report STP2, have been included in Sybiz Visipay 23.00.

New employee data requirements have been automated through the upgrade process but employee records should be checked upon upgrade — especially those that are not regular employees, such as working holiday makers. In most cases additional pay items will be required to be added and Other Allowance pay items should be reviewed to complete their configuration or reclassify them (see below), and new allowances should be created if required.

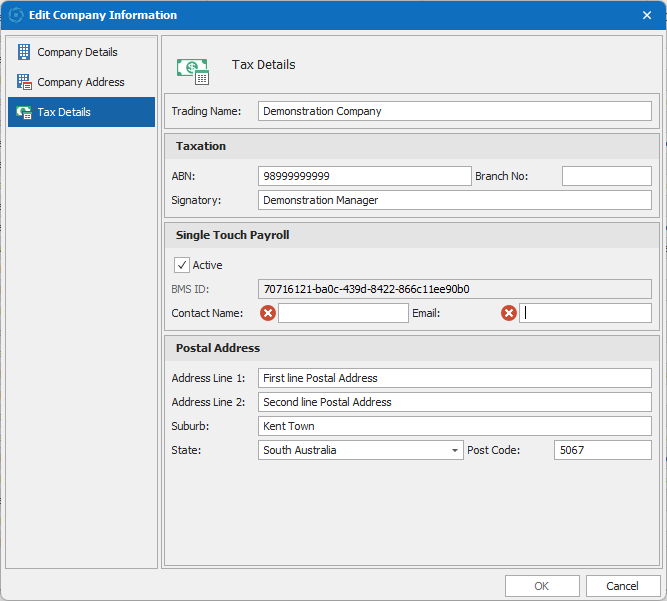

Mandatory Tax Details contact name and email address

The contact name and email address fields are now mandatory under the file menu > Company > Tax Details.

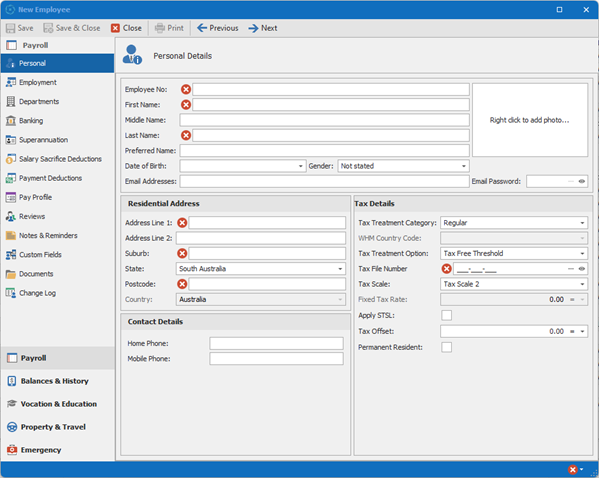

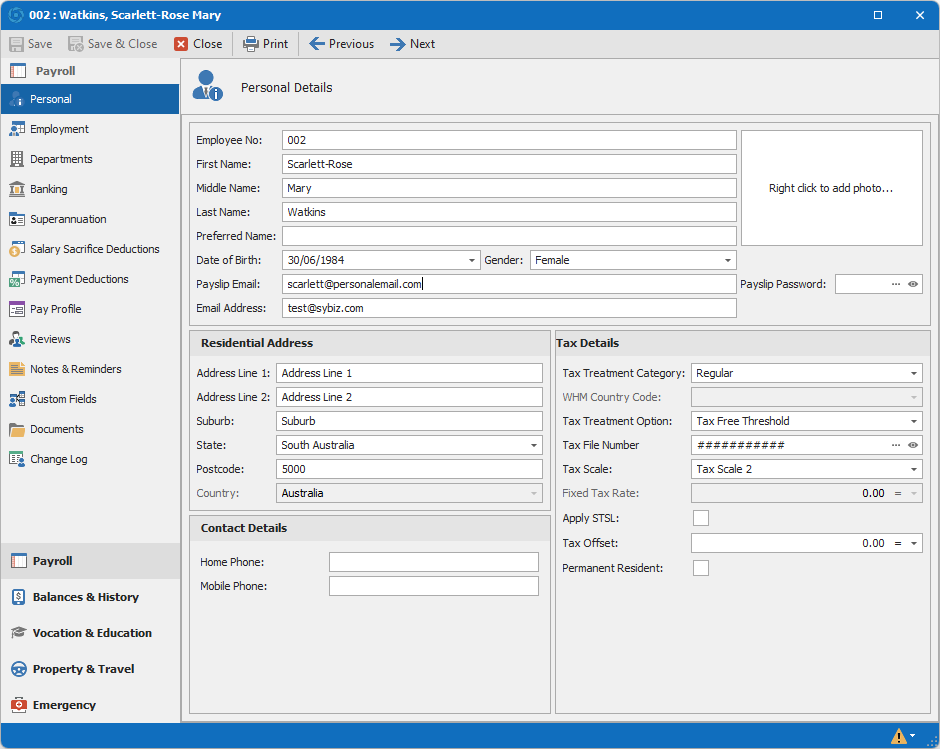

Mandatory personal detail fields required for STP2

Certain employee fields require data to be entered for STP2. On creation of new employees, these fields will issue errors if no data is entered, whereas other mandatory fields will auto-populate and can be manually changed where necessary.

Employee number, employee name, full address details and tax file numbers have been required data in Sybiz Visipay for STP since its launch.

The Tax treatment category, tax treatment option and tax scale fields are also all required, but values are included by default when creating a new employee and can be updated where necessary. There are a number of new Tax treatment categories as defined by the ATO.

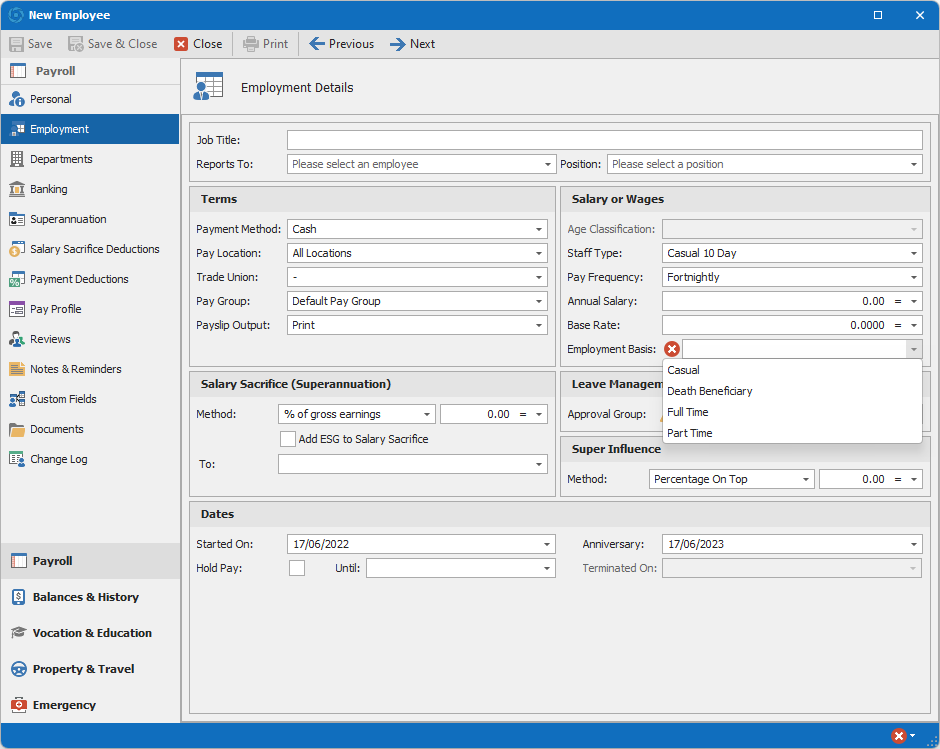

Employment Basis required field

The employment basis of an employee needs to be classified for STP2. Logic is used upon upgrade to set this value for employees to Casual if they are linked to a staff type that is flagged as casual, Full Time if they are linked to a staff type with a working week of at least 35 hours and Part Time for all others. Note that other options such as Death Beneficiary are available and must be manually selected if relevant. The Non-Employee option (such as contractors etc.) is not supported in Sybiz Visipay 22.20 and will be reverted via the same logic as other employees on upgrade to this version.

For clarification on setting the correct employment basis, please consult with the ATO or your trusted business advisor.

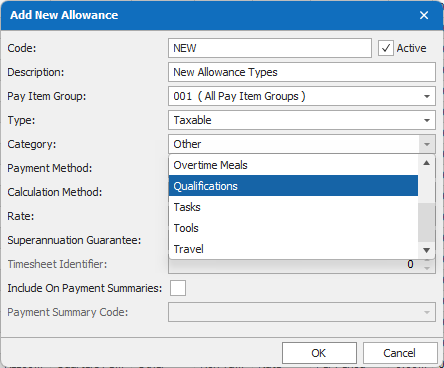

New allowance types

There are three new types of allowances being Qualifications, Tasks and Tools. These would have previously been listed as Other under STP1 and if you provide these allowances we recommend creating new allowances for the new specific categories for STP2.

Some allowance types renamed

Additionally, the way Other allowances are reported has also changed in that a code is transmitted in the STP2 report, rather than the description which was previously used. All Other allowances will need to be edited and a code selected from the Payment Summary Code list for use with STP2.

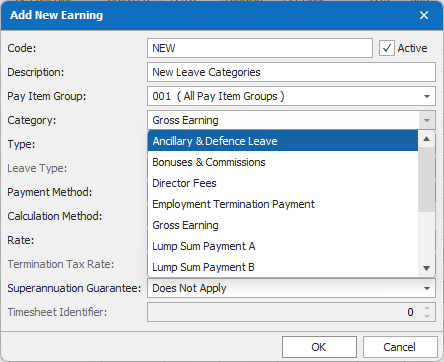

New Leave Categorisations

Some new Leave Categorisations (found in Lookups > Payroll > Earnings) have been defined by the ATO, including Ancillary & Defence Leave, Workers Compensation & Paid Parental Leave. These new categories have been added to support the new reporting requirements in STP2 for non-accruing leave.

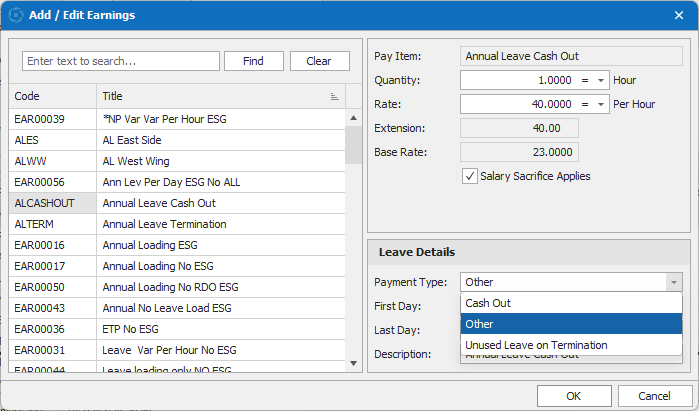

New Payment Types for leave when processing pays

Under STP2 it is necessary to use new Payment Types for leave when processing pays. These are now available in Sybiz Visipay as defined by the ATO. The Payment Types include Cash Out, Unused Leave on Termination and Other. Please note that Other is terminology used by the ATO and represents the normal taking of leave, for example, when an employee takes annual leave for a holiday.

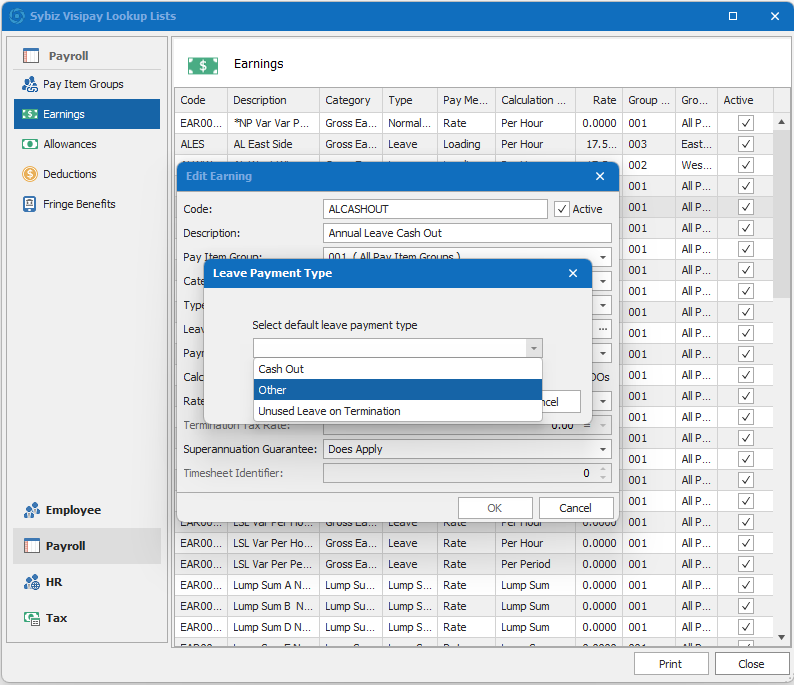

New default payment type for leave

When adding a new earning, a new ellipses menu is available to select a default leave type where preferable, making adding additional leave earnings an easier process. If no default leave payment type is specified, ‘other’ will be used. (CR2203-0422)

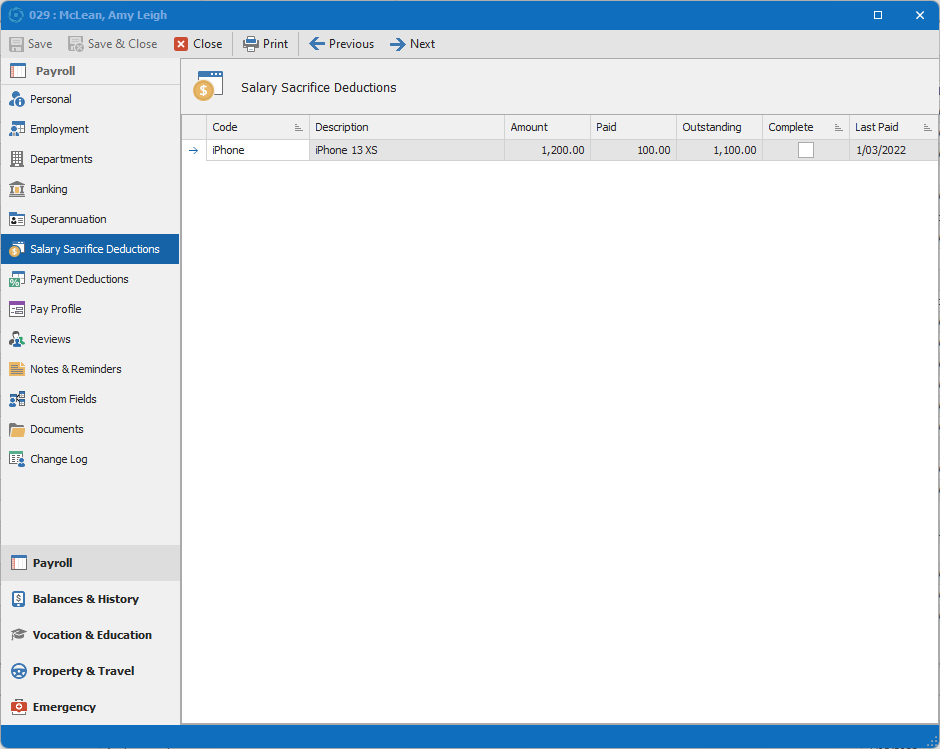

New Salary Sacrifice and Payment Deductions features

The reporting of salary sacrifice under STP2 has changed compared to STP1. In STP2, the source of the salary sacrifice remains at its pre-sacrificed value and the salary sacrifice is reported separately. The key change that is required when processing salary sacrifice other for reporting under STP2 is that the sacrifice is now processed as deduction, rather than a negative earning item. The deduction must be offset against Salary Sacrifice Deductions added to employees' records. Individual records can be created for each salary sacrifice or a single item can be used to offset all salary sacrifice deductions.

Payment Deductions can also be configured in the Employee’s record which facilitates the tracking of loans (or similar) and the repayments.

Enhancements

All new Payslip email address

Employees can now choose to have a separate email address to receive their payslips (for example, a personal email address), whilst also having an email address for other communications via Sybiz Visipay, such as leave requests, approvals and logins. The new payslip email address is optional. (CR210446114)

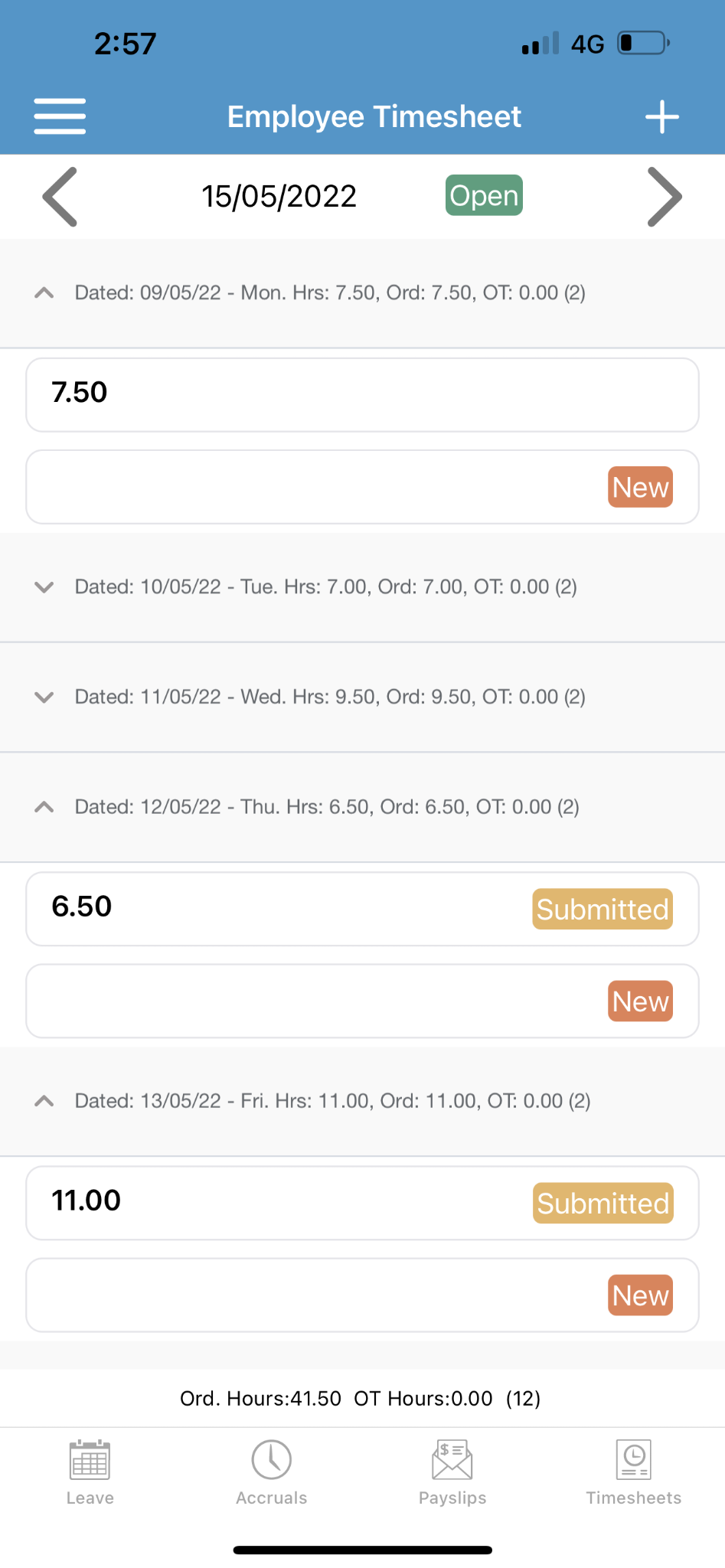

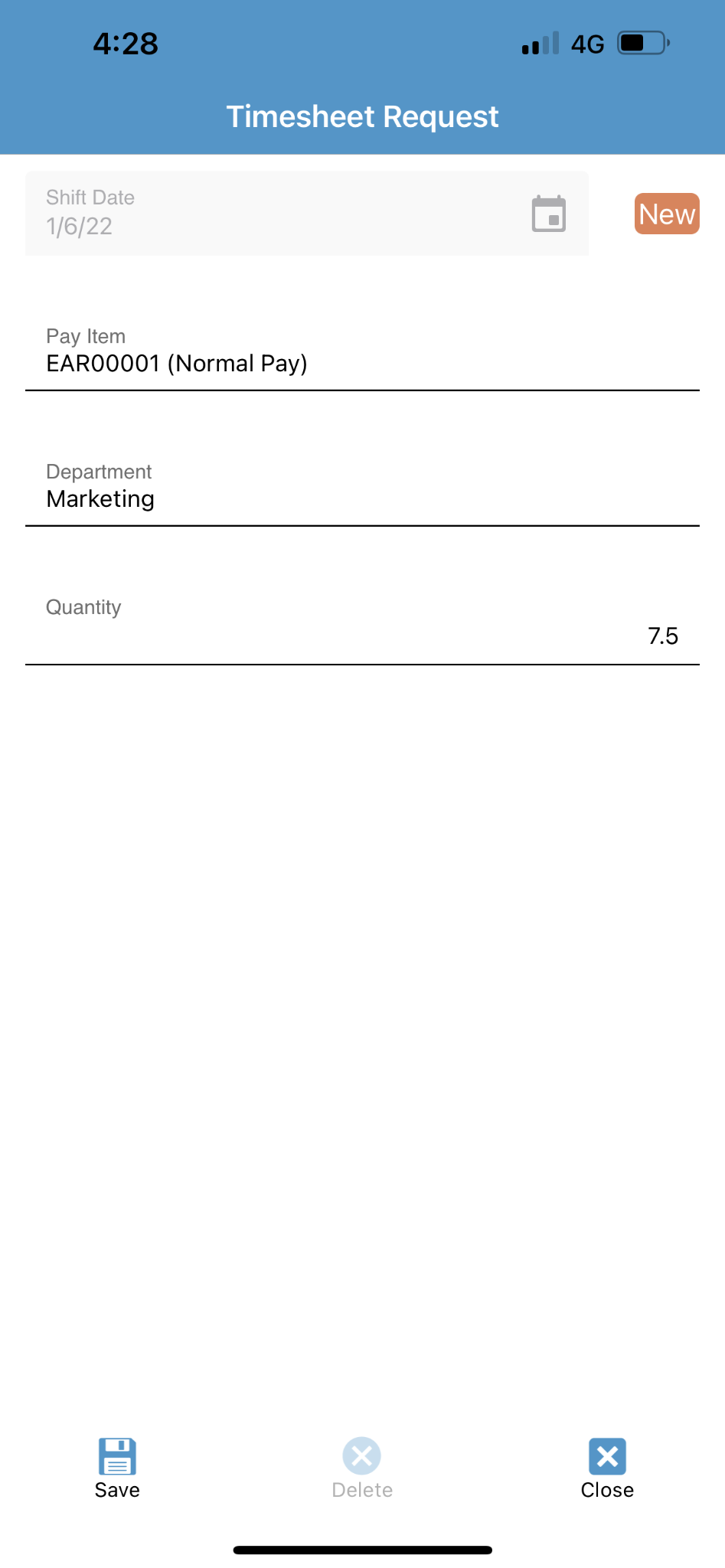

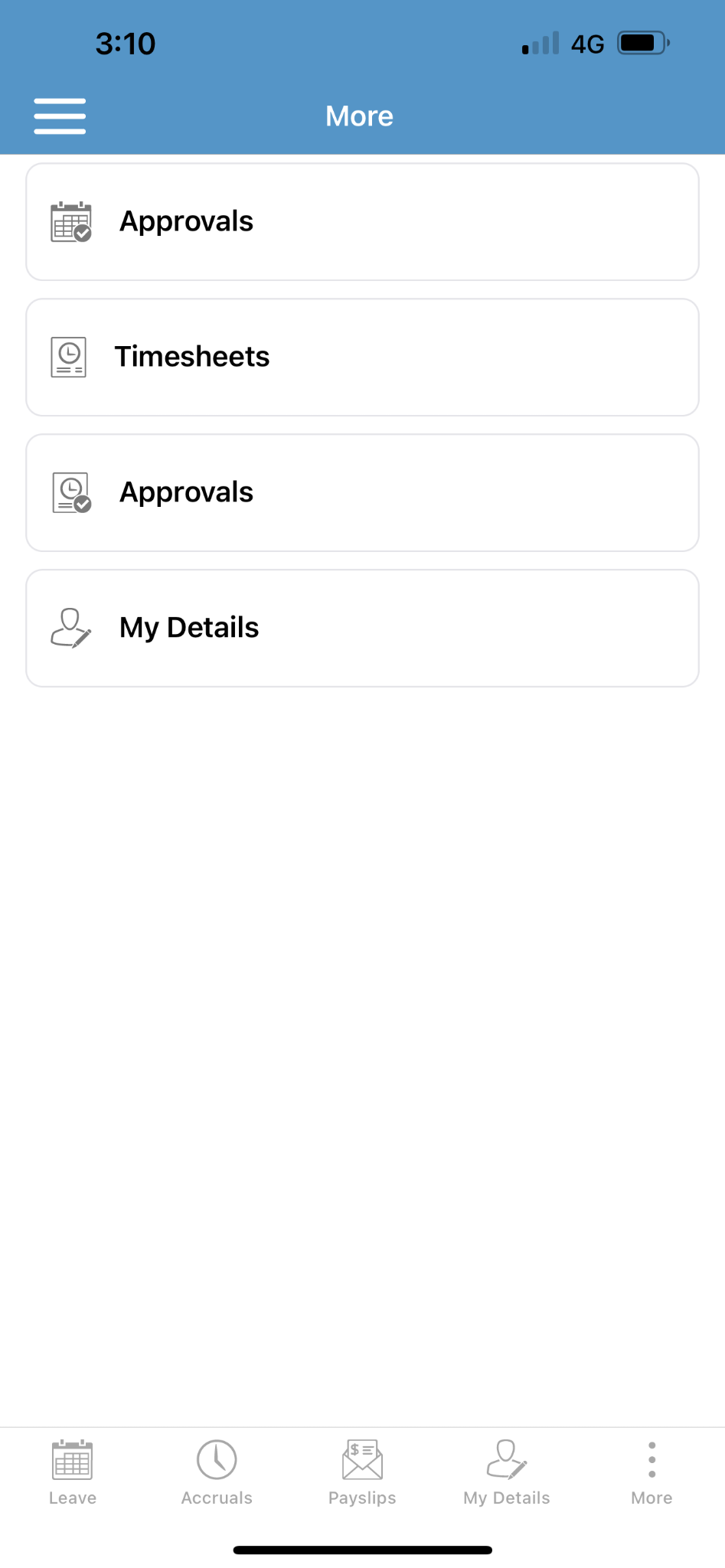

Timesheet Management is now in the ESS app!

Timesheets are now able to be accessed via the ESS mobile app as well as on the ESS portal. Scroll through dates with a swipe of your finger, quickly add and submit your hours whilst seeing your total hours accumulated for the week at the bottom of your screen. Employees can now manage their time on the go, while employers and managers can approve hours easily from their mobile device.

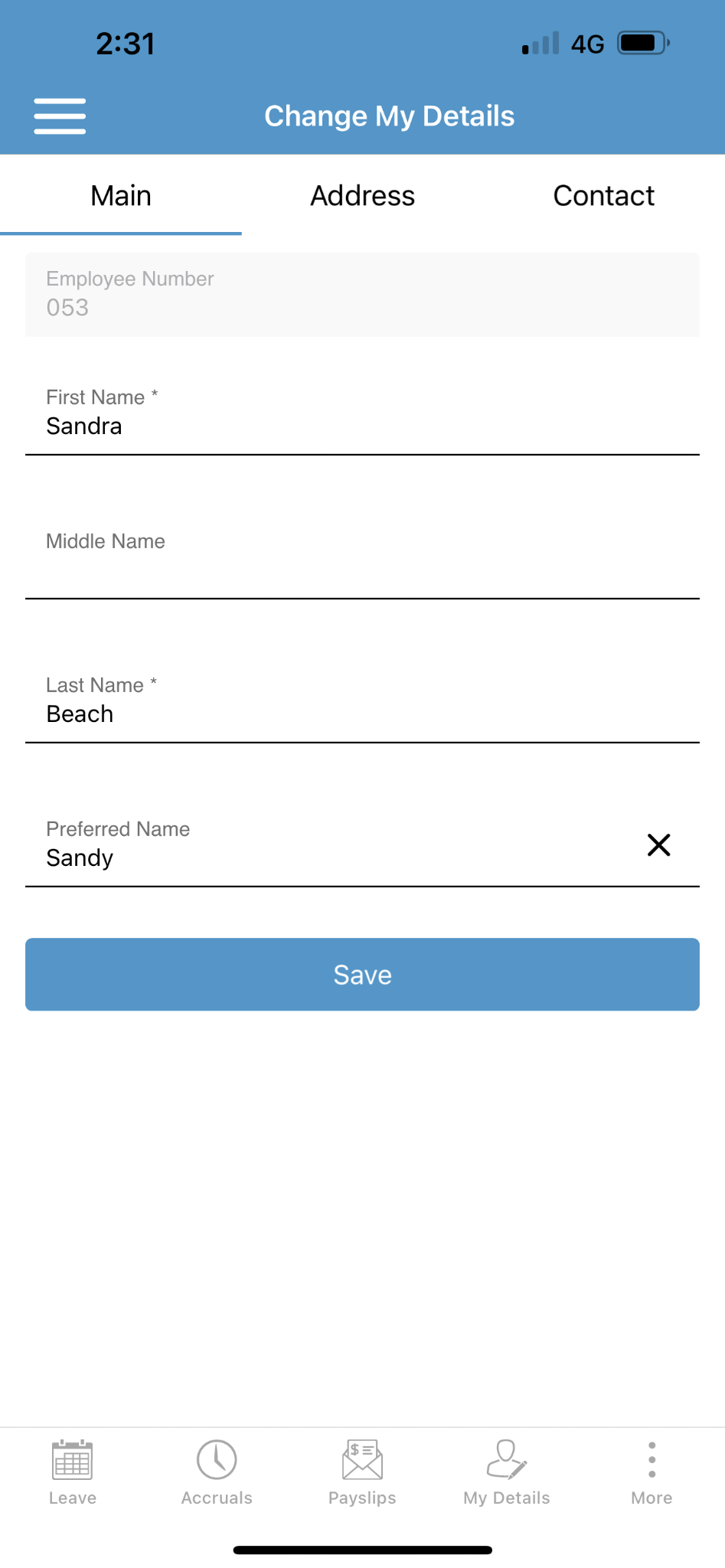

Update employee details from the Visipay ESS app

Employees can now update their personal details direct from the Visipay ESS app, as they can via Sybiz Visipay and the ESS portal, expanding the app functionality even further. (CR210646294, CR2208-1024).

Process a LumpSumE payment to other financial years

Sybiz Visipay now captures additional information to allow LumpSumE payments to be processed up to 5 years in the past, in line with STP2, making transaction corrections a simple process. (CR2208-1100)

New adaptable view in Timesheet Approval screens

The Timesheet Approval screen now has collapsible/expandable headers to more clearly display employees requiring timesheet approval. The header of each employee can be right-clicked to approve all timesheet data for that employee, allowing for a quicker approval process. Employees can then be expanded on by days and data for more information where needed. For users who prefer to see all employee information initially, there is also quick way to fully expand the screen.

These changes apply in a similar way to the Visipay ESS mobile app. The Timesheet Approval screen within the app is displays as a summary page, allowing for the high-level approval of timesheets or a detail page can be opened for further information. (CR2211-1371)

Fixes & Improvements

23.00

- Filtering employees in the ESS Leave Calendar works as expected. (CR211047043)

- If an employee has an ETP processed with no super, and no other pays for that financial year, the STP1 and 2 reconciliation reports will no longer result in error. (CR2206-0819)

- STP now includes employees with non-taxed ETPs only. (CR2207-0869)

- Employees with a positive payslip in the current period but zero gross pay for the financial year will report for STP2 correctly. (CR2208-0993)

- Changes have been made to the logic to determine if Microsoft Outlook is installed, preventing errors on some servers. (CR2209-1141)

- ESG is no longer applied to loading only earnings items. (CR2209-1212)

- Editing an employee and accessing the Pay Profile when processing pays will no longer cause an error. (CR2210-1265)

- Non-accruing leave pay items that are configured to act as leave for leave management and reporting purposes now report as expected, including a historical data fix. (CR2210-1344)

- When changing an allowance category from Other to a different category, the payment summary code is now cleared once the data has been saved to the database. (CR2211-1356)

- Users that are not assigned to an employee are now prevented from logging into ESS Web and the Visipay ESS app. (CR2211-1374)

- Submitting STP2 will now send the telephone number with all spaces removed, resolving issues with SybizSuper submissions. (CR2211-1412)

- Numerous other minor improvements have been included in this release: (CR2208-1019, CR2211-1370)