What’s New Sybiz Visipay 22.00 - 22.24

Important Information

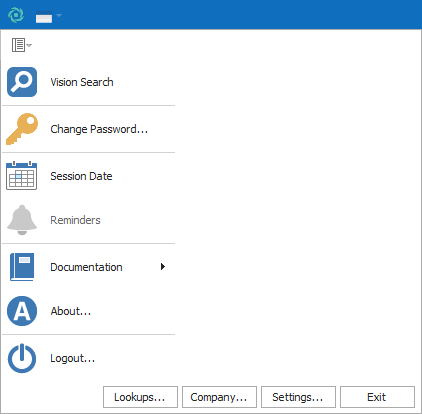

Changes to main file menus

Company Detail maintenance options (Company) have now been separated from email and other common setting options (Settings) in the main file menus in Sybiz Visipay. Jump to enhancements for more information. (CR190942075)

Quarterly superannuation threshold checkbox option

If employee staff types are set to allocate super on a fixed basis, the 'Quarterly Superannuation Threshold Applies' checkbox should not be ticked or super could calculate incorrectly. The figure represented in the 'amount' field for staff types paid on a fixed basis has also changed from a per period amount to a per annum amount. (CR190540838)

$450 minimum monthly superannuation threshold change

Although slated to be discontinued in the near future the option to apply a $450 minimum monthly earning threshold before paying superannuation has been extended to apply to all employees (via staff types), irrespective of their nature of employment. Previously, Sybiz Visipay only applied this to casual employees. (CR160328877)

A new Web Service for Visipay ESS

Sybiz Visipay’s Employee Self Service and Web Service modules have been merged into one combined module in Sybiz 22, encompassing a brand new Web Service. This change simplifies configuration, implementations and upgrades going forward.

Customers who use the Web Service to power the Visipay ESS app will need to change the URL used in the mobile application for each user to move to the new Web Service, your Sybiz Authorised Business Partner can assist. The ESS mobile app has been designed to handle the current Web Service and the new combined Web Service so there will be some time for existing users to migrate across before the old Web Service is discontinued, however we still recommend upgrading as soon as possible.

Microsoft.NET Framework upgrade

Version 22.00 of Sybiz Visipay utilises Microsoft.NET Framework version 4.8 and therefore some custom add-ons may require updating. Some custom add-ons may require updating prior to upgrading to Sybiz 22. Some older supported operating systems may also be required to download .NET updates prior to installation of Sybiz 22. This update will not affect Microsoft SQL Server but may impact servers running Sybiz Visipay Employee Self Service (ESS).

Any customers on a Microsoft.NET Framework prior to version 4.8 may not be able to web update. We recommend having Microsoft.NET Framework version 4.8 installed and ready prior to upgrading to Sybiz version 22.00 to prevent any complications.

Operating system compatibility

Certain older operating systems (Microsoft Windows XP, some versions of Microsoft Windows Vista and Microsoft Server 2003) and Microsoft SQL Server (2008/2008R2) are not compatible with Sybiz 22.00 - if uncertain consult your Authorised Business Partner prior to upgrading.

Microsoft Windows 11 is supported for Sybiz 22 with compatibility extending to some other later versions of Sybiz solutions.

DevExpress upgrade

Version 22.00 of Sybiz Visipay utilises DevExpress version 21.2.3.

22.10

DevExpress upgrade

Version 22.10 of Sybiz Visipay utilises DevExpress version 21.2.6.0.

22.20

Single Touch Payroll Phase 2 (STP2) deferral extended

The Australian Taxation Office (ATO) has extended Sybiz’s STP2 deferral until 31 October 2022 as they are preferring a staggered roll out among payroll products. This deferral automatically covers all Sybiz Visipay customers.

Sybiz Visipay 22.20 has been released with the new deferral date pre-configured, meaning STP reporting will not switch over to version 2 until 1 November 2022 and there is no action required by users to activate STP2.

Essential upgrade to Sybiz Visipay 22.20 for certain employers

Employers with Working Holiday Makers will need to upgrade to Sybiz Visipay 22.20 to complete the 2021/22 financial year successfully. Further, those employers utilising the new allowance categories (Task, Tools & Qualifications) will be required to upgrade to Sybiz Visipay 22.20 prior to completing their first STP submission for 2022/23. Finally, SybizSuper customers will need to upgrade to Sybiz Visipay 22.20 prior to completing their first superannuation export for the 2022/23 financial year (typically August for monthly contributors and October for quarterly contributors).

Web Service/ESS app requires upgrading

Customers using ESS will be required to upgrade ESS with Sybiz Visipay 22.20. Further, the Web Service that powers the ESS app was upgraded in Sybiz Visipay 22.00, resulting in ESS and the Web Service being combined. The old Web Service will not be supported from Sybiz Visipay 22.20. If you are still running the ESS app from the old Web Service you will need to the new combined ESS/Web Service (named ESS) prior to upgrading to version 22.20. To check your Web Service, please contact your Sybiz Authorised Business Partner.

DevExpress upgrade

Version 22.20 of Sybiz Visipay utilises DevExpress version 21.2.7.0.

New Features

Connect where you need to with mobile solutions for Sybiz Visipay

Since late 2020 Sybiz has introduced a number of new mobile applications, including a completely rebuilt Visipay ESS app, so our users can take their software on the road and connect like never before. All current Sybiz mobile apps are available on both Apple and Google Play app stores now.

Employee Self Service on the go

Sybiz's ESS capability is available on Android and iOS devices. The Sybiz Visipay ESS app gives employers and employees leave management and payslip history in a secure, personalised experience. With dedicated functionality for both staff and approval managers, Sybiz's ESS app is an all-in-one leave management resource that makes working from home and adapting to our changing business environment easier for payroll managers and their staff.

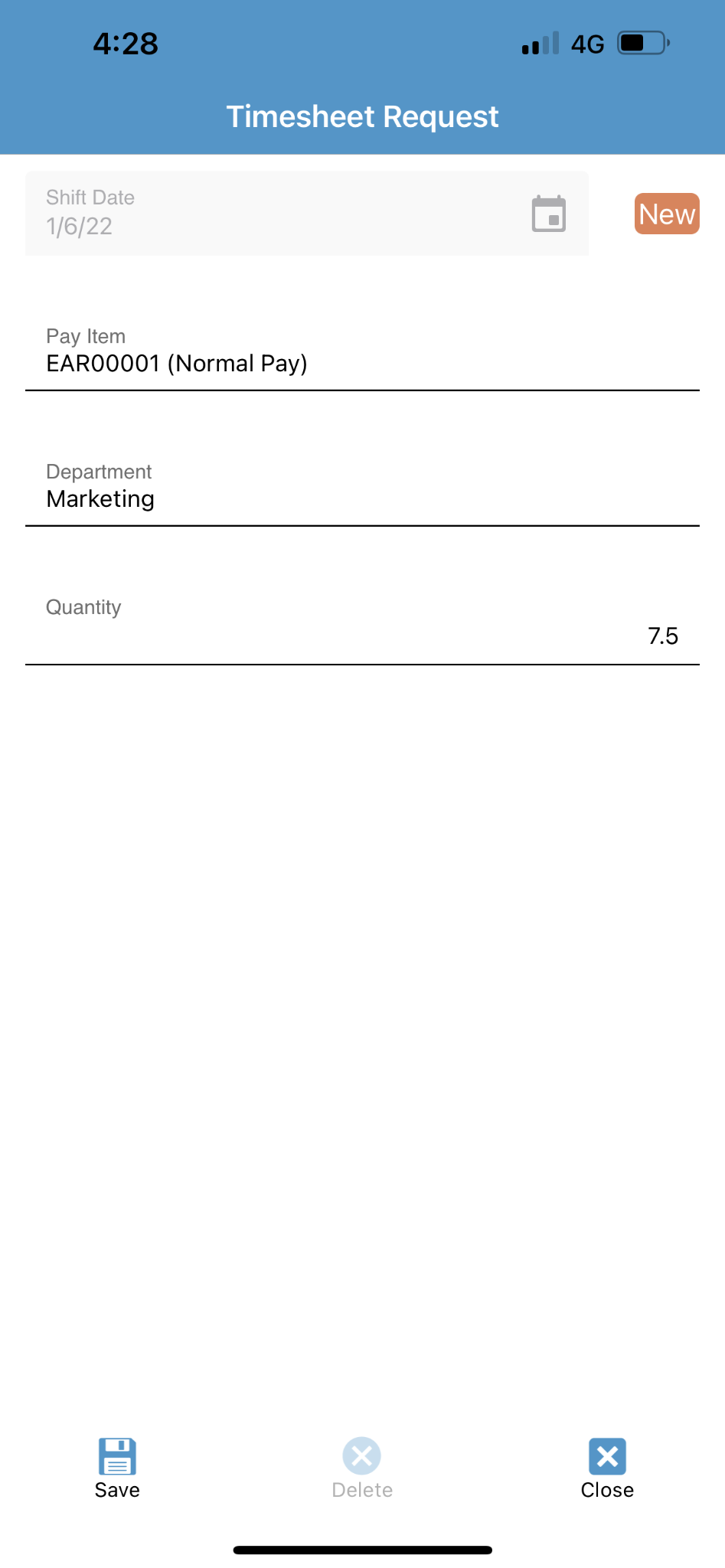

Clock in with Timesheets!

All new Timesheet Management functionality has arrived in Sybiz Visipay. Accessible from Employee Self Service (ESS), staff can now enter, approve and import timesheet data directly into Sybiz Visipay. Tailor your Timesheet processes with easily customisable settings, giving payroll and management staff even more control over an increasingly remote workforce.

The following video outlines setting up and using Timesheet Management in Sybiz Visipay.

The next video demonstrates how Timesheet Management looks in the Sybiz Employee Self Service Portal and how to import Timesheets for processing pays in Sybiz Visipay.

Enhancements

Getting ready for Single Touch Payroll Phase 2 (STP2)

Sybiz has been granted a deferral to the official start date of the Single Touch Payroll phase 2 (STP2) for Sybiz Visipay, and while users may not notice major changes for STP2 in this release, work has already begun behind the scenes to achieve these new requirements seamlessly and to a high standard, as was done with the first rollout of STP back in 2018.

Current users of Sybiz Visipay will be exempt from reporting STP2 until 1 July 2022, instead of the mandated 1 January 2022. The important thing for our Sybiz Visipay customers to keep in mind is that there is nothing you need to do, and this deferral will automatically apply to Sybiz Visipay users. The only reason you will need to apply for a separate employer deferral is if you believe you will be unable to meet your STP2 obligations from 1 July 2022.

Reduce the likelihood of duplicate submissions for STP

Single Touch Payroll (STP) submissions in Sybiz Visipay now exclude payslips that have already been processed from being re-submitted in future STP pay events, giving users more confidence to re-submit STP reporting when required without duplicating data. (CR180838636)

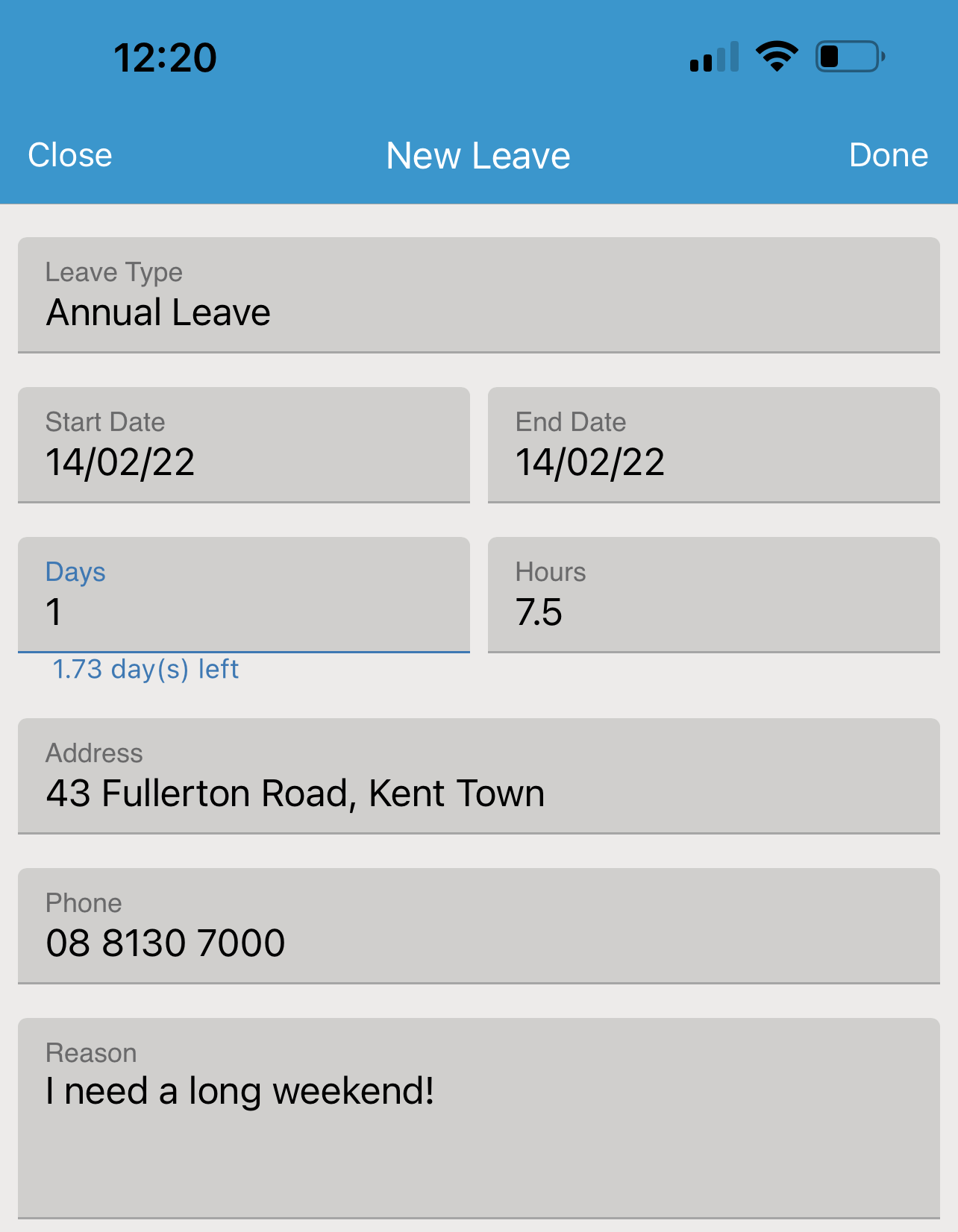

Automatic part day calculations for Visipay ESS mobile app

Sybiz's Employee Self Service application for mobile, Visipay ESS, now supports users that apply for leave in days or hours, with either option automatically calculating the other. This enhancement is available on both the Android and iOS versions. (CR160730408)

Days left displayed on Visipay ESS mobile app

Day(s) left for the leave type requested now display on new leave requests, making it easier for applicants to see how much leave they are able to request without going into negative.

New Leave Management templates

Editable email templates are now available in Sybiz Visipay for Leave Management related emails. Users can now update email content for employee leave requested, approved and rejected emails. (CR140923171)

New archived payslip purge

A new option has been added to the payslip archive configuration which will allow an administrator to set what period of time archived payslips are to be kept in the system before they are permanently deleted. This new option could free up vital disk space and speed up data back-ups, improving overall performance.

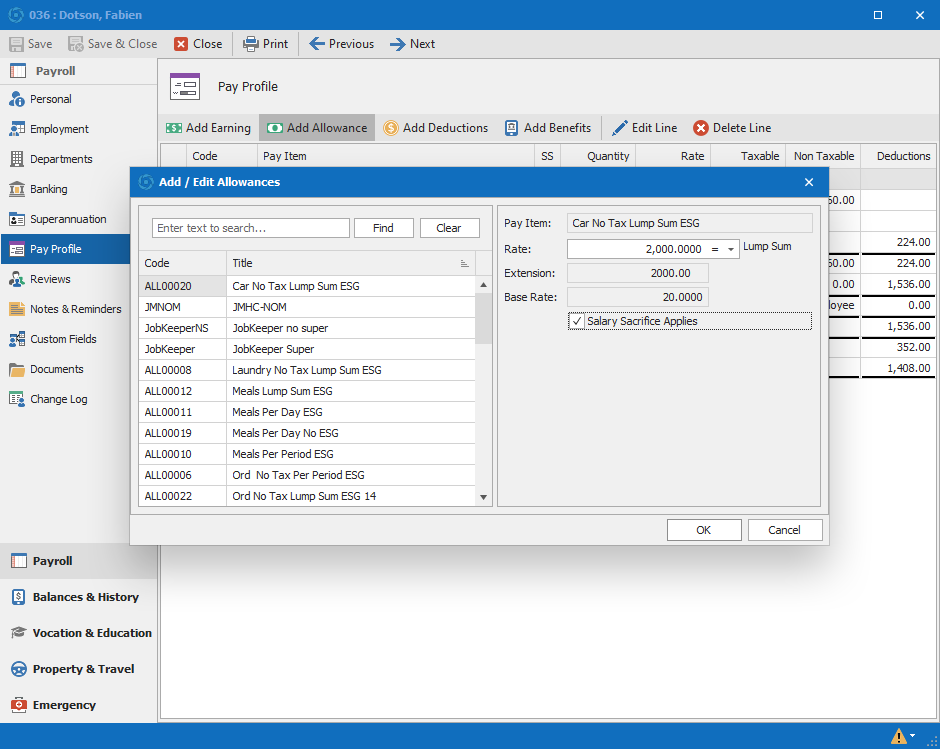

Salary sacrifice for employee allowances

Employee allowances can now be included in salary sacrifices with an easy checkbox option. (CR160630017)

Warnings on timesheet imports with existing unprocessed records

A warning is now shown when importing a .csv Timesheet file with unposted timesheet records to help users better identify and reduce duplicate information being imported. (CR180938858)

Changes to pay profiles in Application Log

When changes are made to pay profiles in Sybiz Visipay an entry is now made in the Application Log for greater clarity over changes made to employee details. (CR190340418)

Improved security for Company Details

Company Detail maintenance options (Company) have now been separated from email and other common setting options (Settings) in the main file menus in Sybiz Visipay. This menu separation will provide a deeper level of permission options to separate users from being able to access and edit company level email, skin and language options and change company specific information such as banking details. (CR190942075)

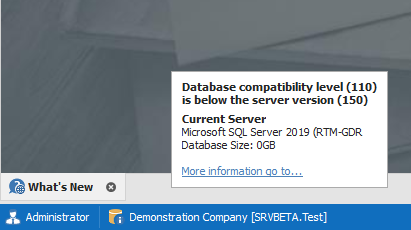

Informative notices for database and server versions

A new notice system in the status bar of Sybiz Visipay will display new warning or error icons for potential issues with database and server versions. This new enhancement will help end users stay more informed about minimum database and server version requirements. (CR210846664)

Improvements to product help file

Sybiz Visipay users will see improvements to the help file in version 22. The help file now opens to the specific section where the F1 key is pressed. (CR210846711)

Banking imports now support amount and allocation percentages

Users are now able to include amount and allocation percentages against bank account detail imports in Sybiz Visipay, allowing easier payment to employees across multiple bank accounts. (CR170834893)

Matching Leave Calendar colour schemes

The colour scheme in the Leave Calendar in Sybiz Visipay now matches the colour scheme of the Employee Self Service web Portal, for easier at-a-glance viewing. (CR210846746)

Improved Payment Summary Reconciliation Reports

The Payment Summary Reconciliation report is now consistent with Payment Summaries with regards to Lump Sum D. (CR180638001)

SybizSuper export versions 1 and 2 retired

Versions 1 and 2 of the SybizSuper export have now been retired along with the old SybizSuper Portal, giving users more clarity over super export versions for the new Sybiz Employer Portal. (CR190841927)

Microsoft Windows 11 compatibility

Sybiz solutions remain compatible with the latest technology and support newly launched operating system Windows 11, including display changes such as rounded borders.

22.08

Getting ready for Single Touch Payroll Phase 2 (STP2)

Sybiz has been granted a deferral for Single Touch Payroll phase 2 (STP2) reporting via Sybiz Visipay, and while users may not notice major changes for STP2 in this release, STP2 reporting will only be possible from Sybiz VIsipay 22.20 and after rolling into the 2022/23 financial year.

Current users of Sybiz Visipay will be exempt from reporting STP2 until 1 July 2022. The important thing for our Sybiz Visipay customers to keep in mind is that there is nothing you need to do regarding this deferral which automatically applies to all Sybiz Visipay users. The only reason you will need to apply for a separate employer deferral is if you believe you will be unable to meet your STP2 obligations from 1 July 2022. (CR2202-0223)

How you can get ready with Sybiz Visipay

Sybiz Visipay 22.10 includes a number of changes that will help our customers get prepared for STP2, by entering required data in the front-end, as well as important updates within the back-end of Sybiz Visipay. By ensuring this data has been entered and/or updated in advance of 1 July 2022, customers will be in a good position to start reporting STP2 after upgrading to Sybiz Visipay 22.20 and rolling into July 2022.

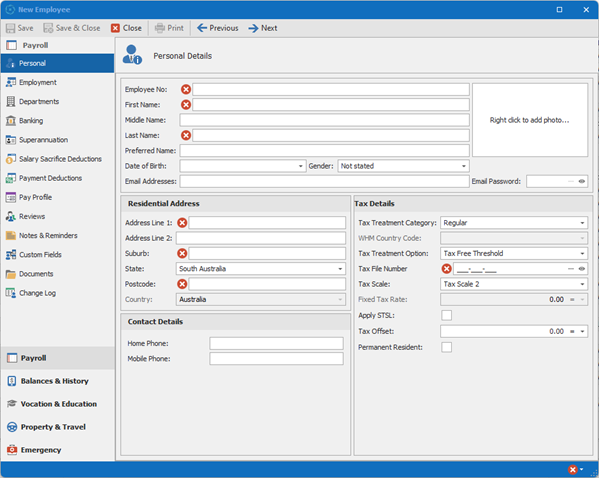

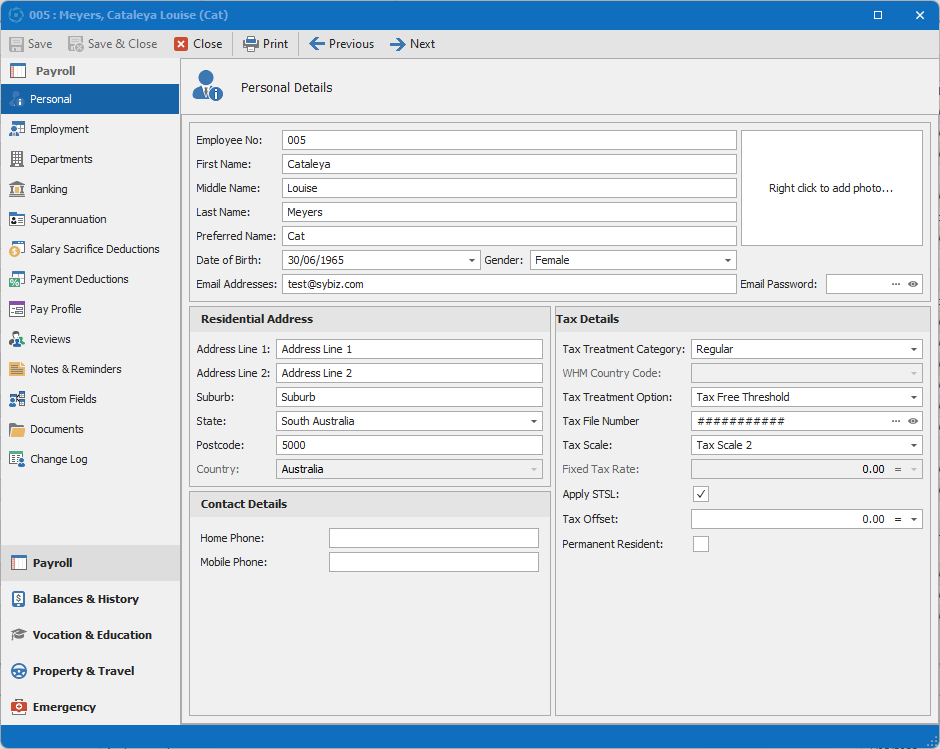

Mandatory personal detail fields required for STP2

Certain employee fields require data to be entered for STP2. On creation of new employees, these fields will issue errors if no data is entered, whereas other mandatory fields will auto-populate.

Employee number, employee name, full address details and tax file numbers have been required data in Sybiz Visipay for STP since its launch.

The Tax treatment category, tax treatment option and tax scale fields are also all required, but values are included by default when creating a new employee and can be updated where necessary. There are a number of new Tax treatment categories as allocated by the ATO.

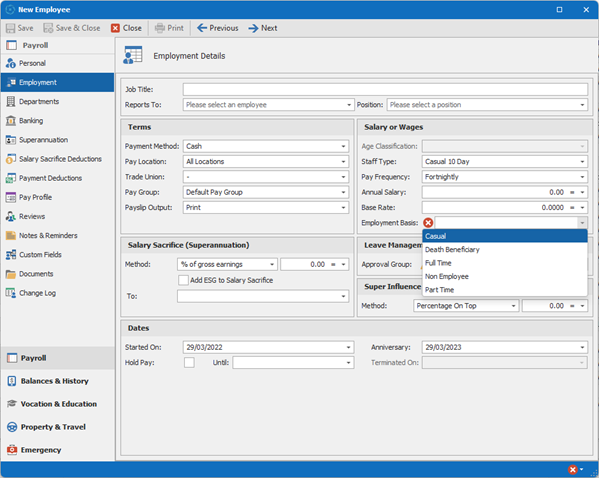

Employment Basis required field

The employment basis of an employee needs to be classified for STP2. Logic is used upon upgrade to set this value for employees to Casual if they are linked to a staff type that is flagged as casual, Full Time if they are linked to a staff type with a working week of at least 35 hours and Part Time for all others. Note that other options such as Death Beneficiary and Non-Employee are available and must be manually selected if relevant.

To update this field, employers will need to accurately determine which employment basis staff fit into. This category is related to staff types (set up in the Lookups menu) and how many hours an employee works. For clarification on setting the correct employment basis, please consult with the ATO or your trusted business advisor.

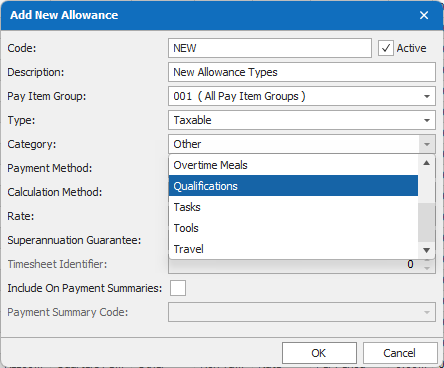

New allowance types

There are three new types of allowances being Qualifications, Tasks and Tools. These would have previously been listed as Other under STP1 and if you provide these allowances you will need to change them from Other to the new specific categories for STP2. It would pay to review all allowances as there may have been some reclassification required.

Some allowance types renamed

Additionally, the way Other allowances are reported has also changed in that a code is transmitted in the STP2 report, rather than the description which was previously used. All Other allowances will need to be edited and a code selected for use with STP2. Refer to the ATO website for the relevant codes.

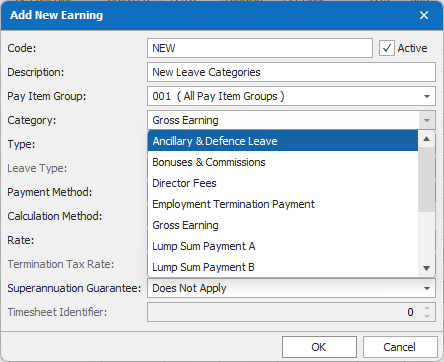

New Leave Categorisations

Some new Leave Categorisations (found in Lookups > Payroll > Earnings) have been defined by the ATO, including Ancillary & Defence Leave, Workers Compensation & Paid Parental Leave. These new categories have been added to support the new reporting requirements in STP2 for non-accruing leave.

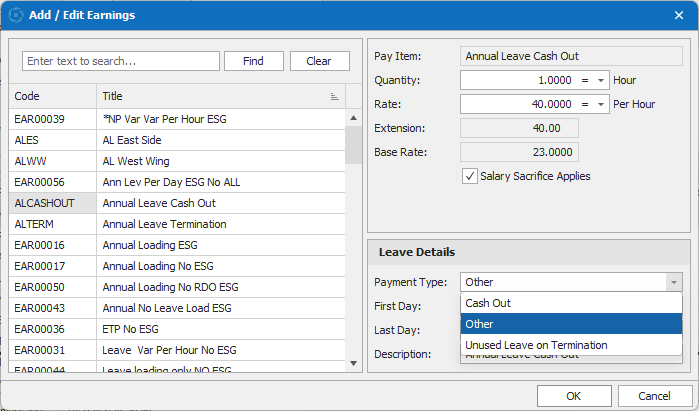

New Payment Types for leave when processing pays

Under STP2 it is necessary to use new Payment Types for leave when processing pays. These are now available in Sybiz Visipay as defined by the ATO. The Payment Types include Cash Out, Unused Leave on Termination and Other.

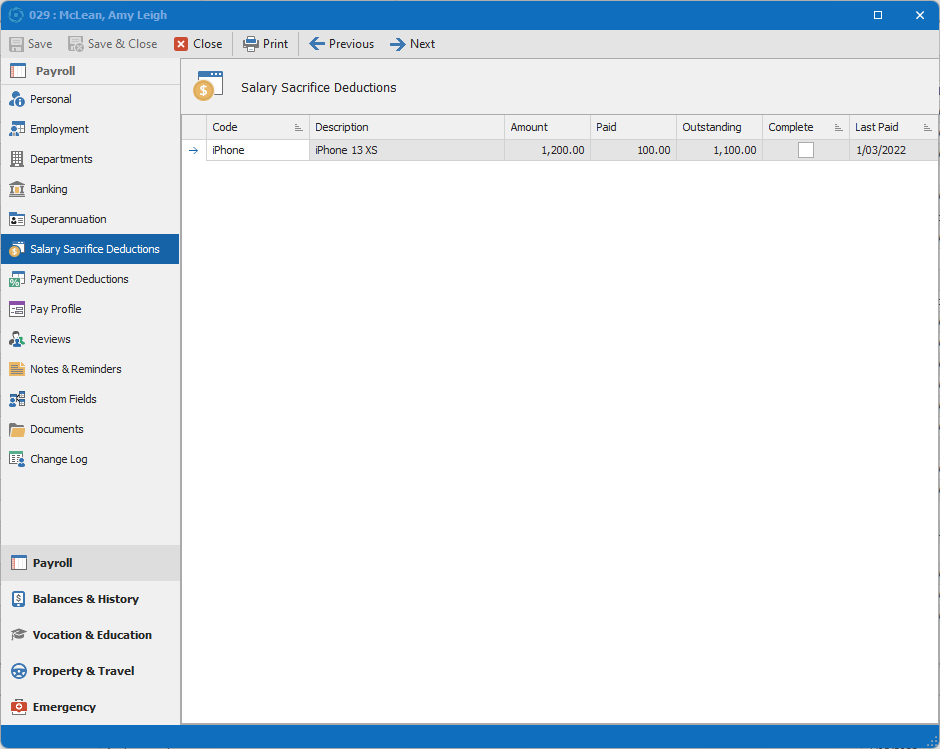

New Salary Sacrifice and Payment Deductions features

The reporting of salary sacrifice under STP2 has changed compared to STP1. In STP2, the source of the salary sacrifice is grossed back up to its pre-sacrificed value and the salary sacrifice is reported separately. The key change that is required when processing salary sacrifice other for reporting under STP2 is that the sacrifice is now processed as deduction, rather than a negative earning item.

These new Salary Sacrifice and Payment Deductions are now able to be configured in the Employee’s record which allows us to keep track of the sacrifice amount vs the benefit attained. This is especially useful if the employee has arranged to periodically sacrifice, rather than sacrificing a single lump sum.

Tax File Number Redaction

The tax file number and payslip email password is now hidden by default but can be made visible as required. The tax file number has also been removed from the employee grid and several standard reports. (CR210445867 & CR2202-0286)

STP active by default

Single Touch Payroll is now switched on by default for new Australian Companies. (CR2202-0262)

22.20

Ready to Report: Single Touch Payroll Phase 2 (STP2)

The Australian Taxation Office (ATO) has extended Sybiz’s STP2 deferral until 31 October 2022. The ATO has had to interact with employers reporting under STP2 to a greater extent than they did with STP1 and the deferral helps the ATO stretch out the volume of employers transitioning to STP2 over a longer time frame. This deferral automatically covers all Sybiz Visipay customers.

Sybiz Visipay 22.20 has been released with the deferral date pre-configured, meaning STP reporting will not switch over to version 2 until 1 November 2022 and there is no action required by users to switch to STP2.

Multiple references are made to the ATO in the content below and ATO resources pertaining to STP2 are readily accessible via the ATO website. The ATO has requested software developers to refrain from republishing the information as it is being updated and extended on a regular basis. Therefore, the ATO resources should be used as the source of this information.

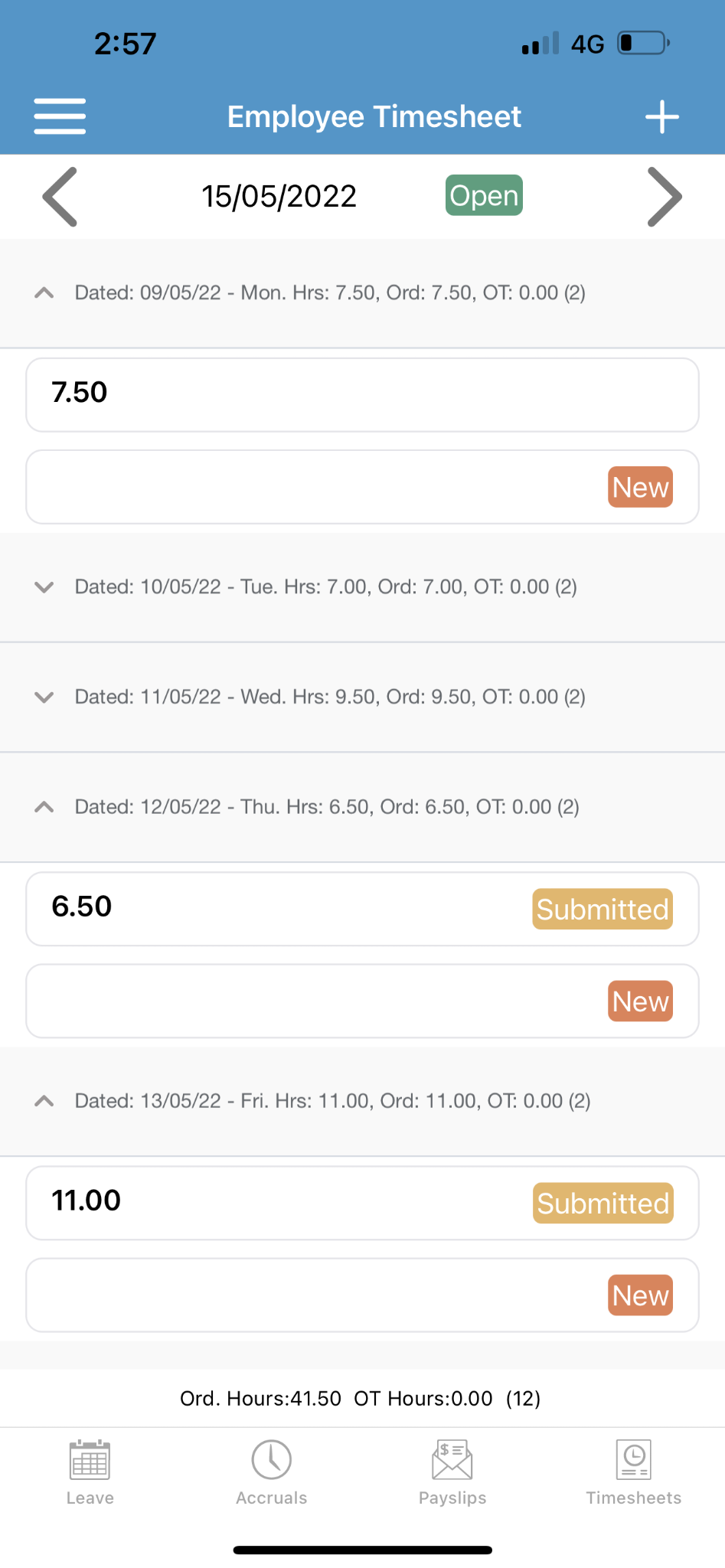

Timesheet Management is now in the ESS app!

Timesheets are now able to be accessed via the ESS mobile app as well as on the ESS portal. Scroll through dates with a swipe of your finger, quickly add and submit your hours whilst seeing your total hours accumulated for the week at the bottom of your screen. Employees can now manage their time on the go, while employers and managers can approve hours easily from their mobile device.

Maximum value of tax scales increased

The maximum value of tax scales has been increased to accommodate larger one-off payments. (CR210746578)

Accrual Tracking History report improvements

The Accrual Tracking History report now uses the last modified date instead of the processing date to improve clarity on any manual changes made to leave accruals. (CR2204-0523)

Statement of Earnings lodgement improved for PNG

Character restrictions have been removed for phone numbers on Statement of Earnings submissions for PNG companies. (CR210345764)

Fixes & Improvements

22.22

- Salary sacrificing an allowance works correctly with STP2 submissions. (CR2208-1041)

22.21

- STP prior year financial data for gross and tax is now reflected as expected. (CR2207-0912)

- Additional amounts of super are accurately recalculated on upgrade and correctly categorised in reports and exports. (CR2207-0898)

- Payslips produced that do not need to be reported via STP (such as payslips with a zero dollar value) are flagged as reported as to not trigger warnings on rollover. (CR2207-0913)

22.20

- Files that are unsupported by the Sybiz Viewer now open in external applications. (CR2206-0709)

- Employees that are only paid superannuation are now in included in STP submissions. (CR2205-0611)

- Opening employee timesheets in the desktop application and ESS no longer results in an error. (CR2205-0585)

- The user name written to the application log and other locations now ignores the way it is entered on the login screen by the user. (CR2205-0580)

- Working Holiday Makers are reported correctly in STP1. (CR2205-0572)

22.12

- More specific errors are now shown when submitting STP reporting with invalidities from version 22.12. (CR2204-0498)

- Employee tab in STP/ATO Transfer now behaves as expected when using pay event from version 22.12. (CR2204-0497)

22.11

- Custom fields now save as expected. (CR2204-0468)

22.08

- Miscellaneous other fixes have been included in this release. (CR2203-0388, CR2203-0428)

22.03

- Attempting to access STP employee information in a large database no longer results in a timeout. (CR2112-0049)

22.02

- Superannuation for under 18s working less than 30 hours per week has been broadened to cover edge cases that were previously excluded. (CR2112-0015)

22.00

- References to AUSkey have been removed and replaced with 'machine credential' now that AUSkey has been decommissioned. (CR191242805)

- Adding a timesheet for approval will now behave correctly when a pay item doesn't exist for the given employee. (CR210846719)

- Age classifications prevent saving if the staff type has not been added. (CR210746561)

- The change log no longer displays data related to leave that is not related to a specific employee. (CR210345794)

- The ability to ignore tax scale updates has been removed, helping prevent users from not applying tax scales when required. (CR180738276)

- Employees paid overtime only as their final pay that causes them to exceed the $450 now have ESG calculated as expected. (CR190540792)

- Users with limited rights will no longer experience an error when attempting to hide the reports panel. (CR200243231)

- Allowances with a sum of $0 will now be ignored for STP purposes. (CR190741317)

- Date selection within the ESS Portal must be done using date picker control and cannot be typed. (CR211046949)

- Payroll journal lines now round per transaction date instead of the entire batch. (CR210846800)

- Employees not paid will no longer be included in an STP pay event. An STP update event must now be used. (CR201245196)

- Department costing after timesheet import now displays correctly. (CR200443520)

- The default location for exporting files now caches to the last place a file was saved, rather than the Documents folder. (CR210946936)

- Numerous improvements have been made to the Visipay ESS mobile application. (CR210245415, CR210145318, CR210145311)

- Some other minor fixes have been included in this release of Sybiz Visipay. (CR200743991, CR190540872)